We provide valuation and advisory services for different client groups. Besides the valuation of real estate according to relevant international and national standards, this also includes advisory services on complex assignments. Depending on the respective client and its individual requirements, we prepare our opinions and reports in English or German language.

We are familiar with properties of varying usage, size, and complexity and cover the entire spectrum, from long-term leased new buildings to distressed assets.

Valuation

We prepare our reports for various valuation purposes. This includes, for example, decisions in connection with property sales, purchases and financing, accounting and tax purposes or the use in arbitration and legal proceedings.

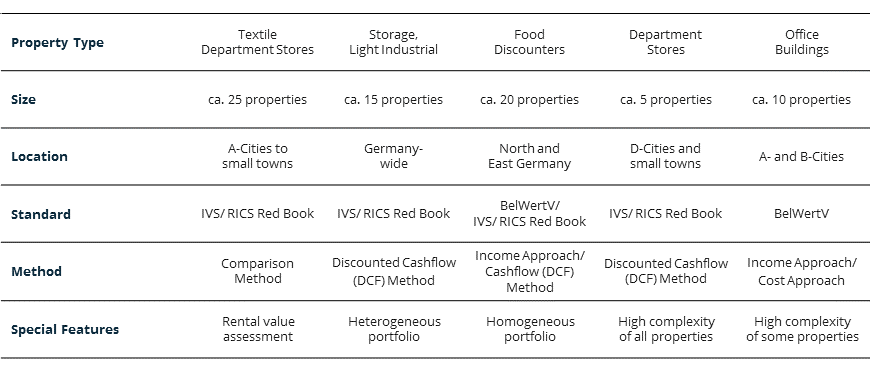

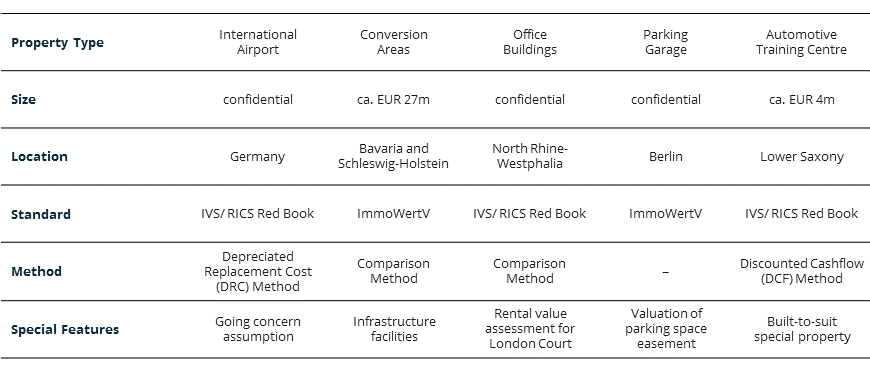

A selection of the properties we have valued and the mandates we have completed, structured by type of use and assignment, is shown below.

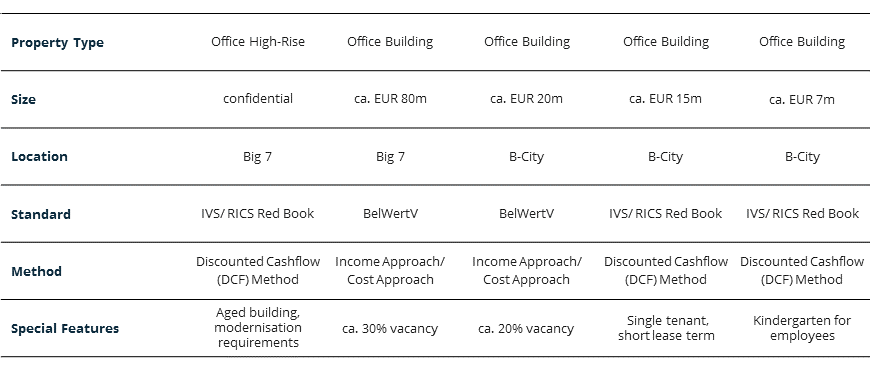

Office buildings can have a variety of specifications that range from small office buildings to skyscrapers, from owner-occupied to multi-let property, or from older building structures with simple fit-out to modern new constructions.

The value of an office building depends to a great extent on the location and the building equipment, as well as the situation on the real estate market.

We have valued office properties throughout Germany, ranging from central locations in large cities to secondary locations in rural areas. We accurately assess the location characteristics and the respective real estate markets, as well as the property-specific characteristics, such as the letting situation or the building quality. All of these factors are included in our valuations, reflecting the prevailing market conditions.

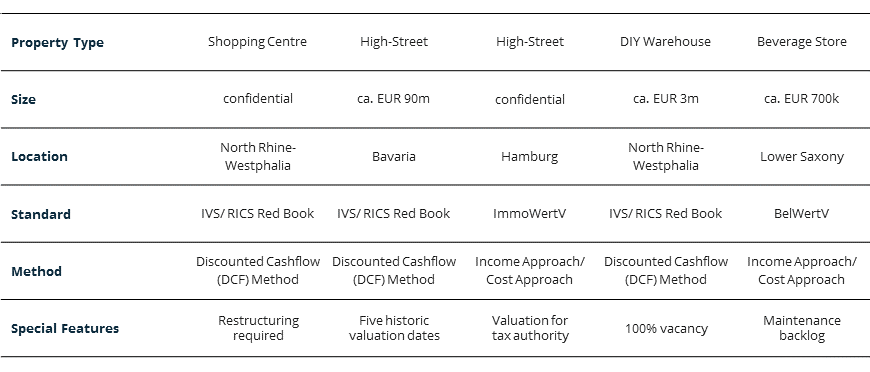

The term retail covers a variety of formats, such as large-scale or smaller shopping centres, retail parks or retail warehouses, supermarkets or discounters, as well as high-street properties or specialty stores.

In addition to factors such as the location, the building type and the competitive situation, the investment quality plays a key role in the valuation of retail properties.

The properties we value range from management-intensive real estate with maintenance backlog, short remaining lease terms or high vacancy rates, to new buildings let on long-term leases. In the retail sector, we cover all property types and asset classes and value both individual properties and large portfolios.

This category includes user-specific production buildings, storage and logistics warehouses, as well as specialist real estate, such as high-bay warehouses. Storage and light industrial property is either used by the owner or held as investment property.

While logistics properties are usually accumulated in established logistics hubs with ideal transport connections, many owner-occupied properties are located in peripheral locations. As a result, the market for logistics real estate tends to be supra-regional, while owner-occupied buildings tend to be influenced by the local market. Thus, we research the respective market situation in the local and national markets and also consider value-influencing factors, such as the transport connection, the delivery situation, or the floor plan layout.

We have assessed both outdated storage warehouses and production buildings, partly multi-storey and with low ceiling heights, as well as modern logistics halls with appropriate storage height and a sufficient number of dock levellers.

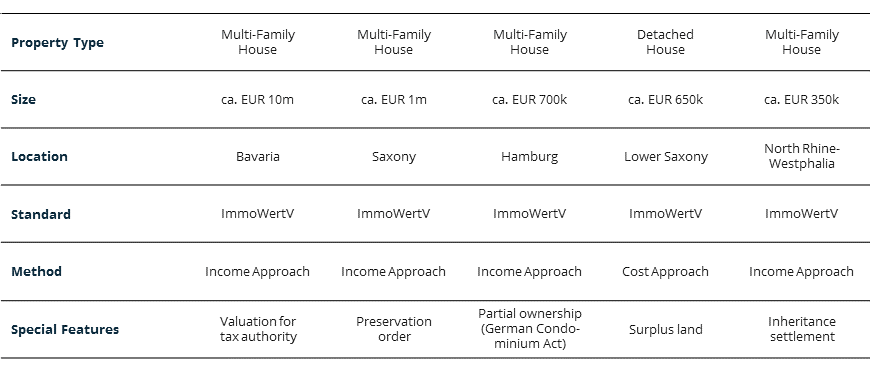

Residential real estate can be divided into investment and owner-occupied property. Investment properties include multi-tenant residential estates, larger housing stocks and individual apartment buildings, while single-family homes and condominiums are usually occupied by their owner.

We value residential real estate throughout Germany, regardless of whether it involves luxury apartments in prime locations or social housing in structurally weak regions.

From single-family houses to high-rise buildings, we have valued various types of residential real estate. In addition to the valuation of individual properties, we also value large residential portfolios.

Hospitality includes various building classes that range from simple hostels to residential and nursing homes, as well as high-quality luxury hotels. Hotels are primarily categorized according to their classification and target group.

When valuing hotels, we consider the property and operator structure, as well as the local market. On this basis, we realistically assess the achievable revenues and operating costs.

Regardless of their use, we appraise different types of dormitories, such as student residences, homes for retired and disabled people, or refugee homes. In addition to the market- and building-specific requirements, we also take into account the respective legal framework.

We have valued various building classes from simple hostels to luxury hotels, as well as residential and nursing homes.

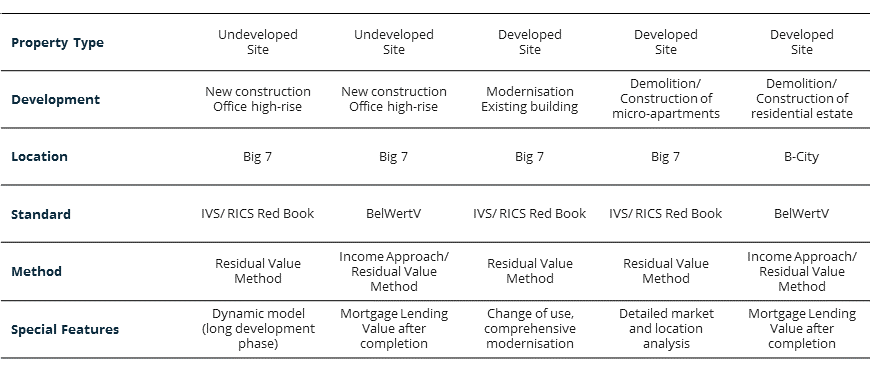

The planning and designing of construction projects is referred to as project development. It involves the modernization of existing buildings or the development of sites – irrespective of the property class.

Considering the highest and best use, the value of a project development is usually determined using the residual value method. The residual, which represents the economically feasible purchase price, is determined by subtracting the project-related costs from the estimated sales proceeds of the completed development.

Depending on the duration and complexity of a development, either static or dynamic valuation methods are used. Due to our proximity to the relevant markets, we correctly assess the prospective sales proceeds of a project development. Based on our current experience values, we also determine the development costs realistically. All resulting values are then verified by considering comparable evidence and deploying construction cost databases.

We have valued project developments of differing sizes and types of use, from residential buildings and estates to hospitality properties and office towers with more than 50 storeys.

A portfolio consists of several properties and can have varying characteristics. Pure residential portfolios usually have a homogeneous structure, while heterogeneous portfolios are characterized by differing types of uses, risk classes, and property specifications.

The value of a specific portfolio can be assessed using the cluster method or by determining and aggregating the values of each individual property. The cluster valuation is an efficient way to determine the value of homogeneous portfolios by grouping properties with similar characteristics. Individual assumptions are then applied to the established clusters. If a cluster valuation is not specifically instructed or not feasible due to a portfolio’s complexity or heterogeneity, the aggregated individual valuation method is used.

When valuing a portfolio, we consider the characteristics of each property as well as the whole portfolio. In addition to providing realistic values, our market-driven and consistent approaches also ensure the comparability of individual valuations within the portfolio.

We have valued portfolios with a wide range of sizes and uses, consisting of inner-city department stores, discounters, office buildings, as well as warehouse or logistics properties.

Special valuations are all valuations of specialised property or assignments with specific peculiarities.

We have experience in the valuation of infrastructure facilities, such as airports or power plant sites, as well as other specialized real estate. In addition, we value complex encumbrances or prepare valuation reports for courts located outside of Germany.

Where requested by the client, we also consider special assumptions, such as assuming a going concern.

Advisory

We advise sellers and buyers, landlords and tenants, as well as the financial sector and the construction industry. Taking into account the specific issue at hand, we determine the nature and extent of the required services together with our clients.

Examples of advisory projects that we have successfully completed are presented below.

We advise sellers on the sale of individual properties or real estate portfolios.

In addition to advising on the structuring of the sales process, we support our clients over the entire duration of the sales mandate. This includes, inter alia, assistance in creating the data room, in the document analysis, in supervising external service providers, in the broker management, and in the negotiations with prospective buyers.

We have successfully supported the seller side in the selected transactions presented below:

- Multiple retail portfolios of different sizes (5 to 30 properties of various types and uses)

- Residential portfolio with approx. 1,500 residential units in 10 North German cities

- Several mixed-use properties (office, retail, leisure, and hotel use) from Lübeck to Munich

We advise buyers both on the purchase of individual properties and real estate portfolios, as well as on the acquisition of loan portfolios that are secured with real estate collateral. We provide our services through the entire process, from the due diligence over the preparation of business plans to the development of a suitable workout strategy for each individual property.

Most recently, we advised our clients on the following projects:

- Due diligence on the acquisition of a specialised property (Research and Development Centre)

- Negotiation support on the purchase of an underground parking garage

- Acquisition advice on the purchase of a heterogeneous NPL portfolio with real estate assets throughout Germany

- Advising a bidding consortium on the acquisition of a NPL portfolio of properties of various types and sizes in the Netherlands and Germany

In recent years, we have advised landlords on the following tasks:

- Optimisation of a large real estate portfolio for a Special Servicer, including the identification of potential, as well as the examination and implementation of value enhancing measures

- Negotiating support with public authorities, for example within the scope of the cancellation of a parking space easement (multi-storey car park) or the coordination of an urban development contract (building renovation)

- Advice on the negotiation of a lease agreement for a bowling alley

- Assessment of the market rent for a production plant and support of the tenant in the subsequent lease negotiations

- Determination and comparison of rental expenses and construction costs as decision-making basis regarding the renting of a production facility versus a development by our client

We also advise our clients on development projects, for example regarding the revitalization of existing properties or the conception of undeveloped land.

An example of our advisory expertise is the project development of a site with existing building law for residential use. In this context, we have compared the expected sales proceeds of each option and analysed the respective opportunities and risks.

In a further project related to the relocation of a production facility, we have determined the costs of converting an existing property and compared these with the costs of a new construction.

For example, we have reviewed an international market value report according to RICS standards for a landmark building in a German metropolis. We identified several technical and formal deficiencies that had resulted in a value assessment well below the actual market level. Our results were documented in an objective written statement and discussed in detail with the report’s author and our client. Subsequently, the report was extensively revised and a formally correct, comprehensible and market-oriented report was prepared for our client.

In another project, the sale of a property located in a redevelopment area was denied by the municipality. The prohibition was based on a valuation report prepared by the local valuation advisory committee that had disclosed a market value well below the negotiated price. Our review of the report showed that material circumstances were not considered in line with the market. In order to obtain approval for the sale, we provided our client with the results of our examination in a detailed statement, thereby providing him with conclusive arguments for the negotiations with the authorities.

Another example is the review of mortgage lending valuations to minimize the risk of the financing bank in an audit by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin). In this context, we have examined the compliance of a large number of mortgage lending valuations with the prevalent formal requirements as to ensure revision safety for our client.